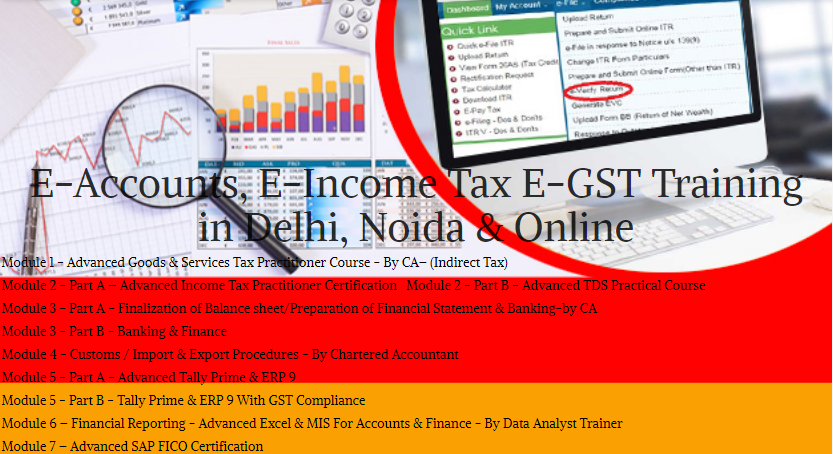

The Rise of Remote Accounting Jobs: Why an Accounting Course is Key in 2025, Accounting Training in Delhi, 110027 New Income Tax Course DTC 2025 Classes – by SLA Consultants India

The Rise of Remote Accounting Jobs: Why an Accounting Course is Key in 2025

With rapid advancements in cloud-based accounting, AI automation, and global finance, remote accounting jobs are becoming more common in 2025. Businesses worldwide seek skilled accountants who can manage tax compliance, financial reporting, and auditing from anywhere. Enrolling in Accounting Training in Delhi (110027) will equip professionals with the expertise needed to thrive in this growing field.

Why Remote Accounting Jobs Are on the Rise

-

Growth of Cloud Accounting & AI Automation

- Businesses now use Tally, QuickBooks, Xero, and SAP to manage finances remotely.

- Accountants must learn AI-driven tools to automate bookkeeping and data analysis.

-

Global Demand for Tax Compliance & Financial Experts

- Companies operating internationally need accountants for cross-border taxation and compliance. Accounting Course in Delhi

- The Direct Tax Code (DTC) 2025 brings new regulations, increasing demand for tax professionals.

-

Cost-Effectiveness & Business Flexibility

- Companies save on office expenses by hiring remote accountants and virtual CFOs.

- Freelance accountants can serve multiple clients worldwide, increasing their earning potential.

-

Work-Life Balance & Career Growth

- Remote accounting jobs offer flexibility, location independence, and high salaries.

- Certified professionals can work as tax consultants, financial analysts, or audit specialists from anywhere.

How an Accounting Course Can Help You Secure a Remote Job

Enrolling in an Accounting Training Program ensures:

✔ Mastery of AI-driven accounting software & cloud-based tools

✔ Expertise in DTC 2025, GST compliance, and corporate taxation

✔ Hands-on experience with real-world financial case studies

✔ Job placement support for remote and freelance accounting careers

New Income Tax Course DTC 2025 – A Must-Have for Remote Accountants

SLA Consultants India offers a New Income Tax Course DTC 2025, covering:

Latest tax reforms under the Direct Tax Code (DTC) 2025

Income tax return filing, GST compliance, and international taxation

Practical training in AI-driven financial software

Guidance on working as a freelance tax consultant or remote accountant

Conclusion

With the rise of remote accounting jobs, professionals with digital finance skills, tax expertise, and AI-driven accounting knowledge will remain in high demand. Enroll in Accounting Training Institute in Delhi (110027) and the New Income Tax Course DTC 2025 at SLA Consultants India to secure a successful remote accounting career in 2025.

SLA Consultants The Rise of Remote Accounting Jobs: Why an Accounting Course is Key in 2025, Accounting Training in Delhi, 110027 New Income Tax Course DTC 2025 Classes – by SLA Consultants India details with New Year Offer 2025 are available at the link below:

https://www.slaconsultantsindia.com/accounts-taxation-training-course.aspx

https://slaconsultantsdelhi.in/training-institute-accounting-course/

Certified Taxation, Accounting, Finance CTAF Course

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar,New Delhi,110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website : https://www.slaconsultantsindia.com/

Leave a Comment